35+ what is an escrow account mortgage

Your mortgage servicer will deposit a portion of each mortgage payment into your escrow to cover your estimated property taxes and your homeowners and mortgage insurance premiums. Web A mortgage escrow account can be a good budgeting tool.

All You Ever Wanted To Know About Home Mortgages But Were Afraid To Ask Hubpages

You dont have to save for them separately because you make one monthly payment where.

. Web As a part of the mortgage payment escrow benefits both the lender and the buyer by guaranteeing timely payment of property taxes and homeowners insurance. The Real Estate Settlement Procedures Act RESPA generally governs how much borrowers have to pay into an escrow account although state law may provide. By putting money toward.

Web What is escrow. More topics in Evaluating Mortgages Learning Center overview A closer look at escrow accounts. Web An escrow account is how your mortgage lender ensures that your property taxes and insurance are paid on time.

It ensures that your property taxes and mortgage insurance premiums will be paid on time and in the proper amounts. Web Escrow is a legal arrangement in which a third party temporarily holds money or property until a particular condition has been met such as the fulfillment of a purchase agreement. Web An escrow account sometimes called an impound account depending on where you live is set up by your mortgage lender to pay certain property-related expenses.

An escrow account can greatly relieve you when budgeting for big yearly bills like property taxes or insurance. Items like mortgage insurance and flood insurance may also get paid from the account. Escrow refers to a financial instrument generally an account held by a neutral third party on behalf of two parties engaged in a transaction.

Web An escrow account also called an impound account is used to cover your property taxes and homeowners insurance spreading out the cost over your 12 monthly mortgage payments. Escrow accounts are pretty standard and many lenders and loan programs including FHA loans require you to keep an escrow account until you have at least 20 equity. Web An escrow account is funded each month as part of your total monthly payment.

Its an easy way to manage property taxes and insurance premiums for your home. Web Once you become a homeowner a mortgage escrow account is an account used to hold and ensure that some of the major ongoing expenses associated with your home are paid on time. Web Where mortgages are concerned escrow and escrow accounts refer to two slightly different concepts.

If you have a mortgage you likely have a mortgage escrow account. Escrow is the process by which a neutral third party mediates a real estate deal holding money and property in escrow until the two sides agree that all the conditions are met for a sale to close. If theres a line or section for escrow part of your monthly payments have been going into your mortgage escrow account.

If you dont want an escrow account you should work with a lender that doesnt require one make a 20 down. How Does Escrow Work. Web What is mortgage escrow.

An escrow account is required when closing on a home purchase or refinance to protect the buyer seller and all other third parties during the transaction. Assuming a borrower gets the average 30-year fixed rate on a conforming 726200 loan last years payment was 1070 less than this weeks payment of 4504. The money that goes into the account comes from a.

However a mortgage escrow account may be optionalit depends on your loan-to-value ratio LTV and the type of loan you obtain. Web Escrow is when money is held by a trusted third party pending the completion of a deal or transaction. Its used in real estate transactions to protect both the buyer and the seller throughout the home buying process.

Web The Mortgage Bankers Association reported a 77 mortgage application decrease from last week. You wont have to worry about unanticipated costs because. Mortgage payments usually include some portion held in escrow for property taxes and.

Part goes toward your mortgage to pay your principal and interest. Typically a selling agent opens an escrow account through a title company once you and the seller agree on a home price and sign a purchase agreement. Web An escrow account is a contractual arrangement in which a neutral third party known as an escrow agent receives and disburses funds for transacting parties ie you and the seller.

Look on a recent statement or bill. Instead of having to pay those large ongoing property costs in a lump sum once or twice a year you pay a little bit each month into the escrow account as part of your monthly. Web When a mortgage loan has an escrow account the borrower has to pay an estimated portion of the escrow items each month usually at the rate of one-twelfth of the yearly amount thats due.

Web Is an escrow account required for my mortgage. A mortgage escrow account is an arrangement with your mortgage lender to ensure payment of your property tax bill homeowners insurance and if. Lenders use it to make property tax and insurance payments for you.

Web An escrow account is a savings account set up by your mortgage lender to pay property taxes homeowners insurance and other expenses related to owning a home. Web When you close on a mortgage your lender may set up a mortgage escrow account where part of your monthly loan payment is deposited to cover some of the costs associated with home ownership. This practice ensures that.

By contrast an escrow account is usually an. Web What is a Mortgage Escrow Account. Web Should I get an escrow account for my mortgage.

The costs may include but are not limited to real estate taxes insurance premiums and private mortgage insurance. Web Escrow Account Definition An escrow account is essentially a savings account thats managed by your mortgage servicer.

![]()

What Is Escrow And How Does It Work

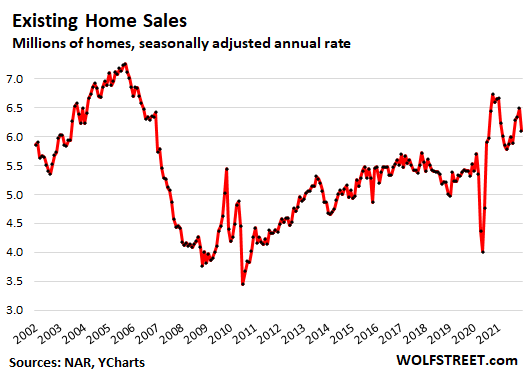

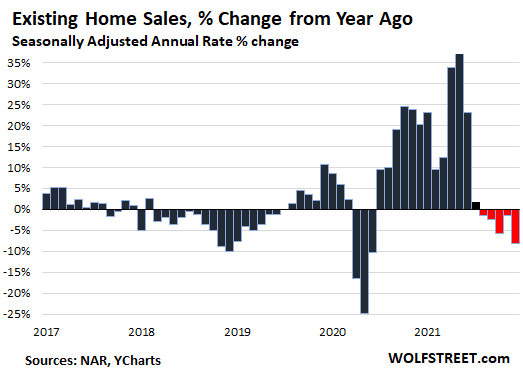

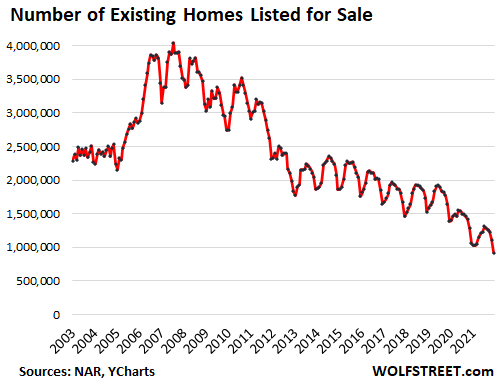

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Fha 203k Loan Renovation Mortgage Loans Explained

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Clean Earth Acquisitions Corp General Corporate Statement Form8 Amended Clean Earth Acquisitions Nasdaq Clin Clean Earth Acquisitions Nasdaq Clinu Benzinga

Reimagining Mortgage Processing With Intelligent Automation Whitepaper

Combining Taxable Rd Gnma Loans With Tax Exempt Bonds And 4 Tax Credits June Ppt Download

How To Calculate An Escrow Payment 10 Steps With Pictures

Mortgage Escrow Account How To Properly Set It Up

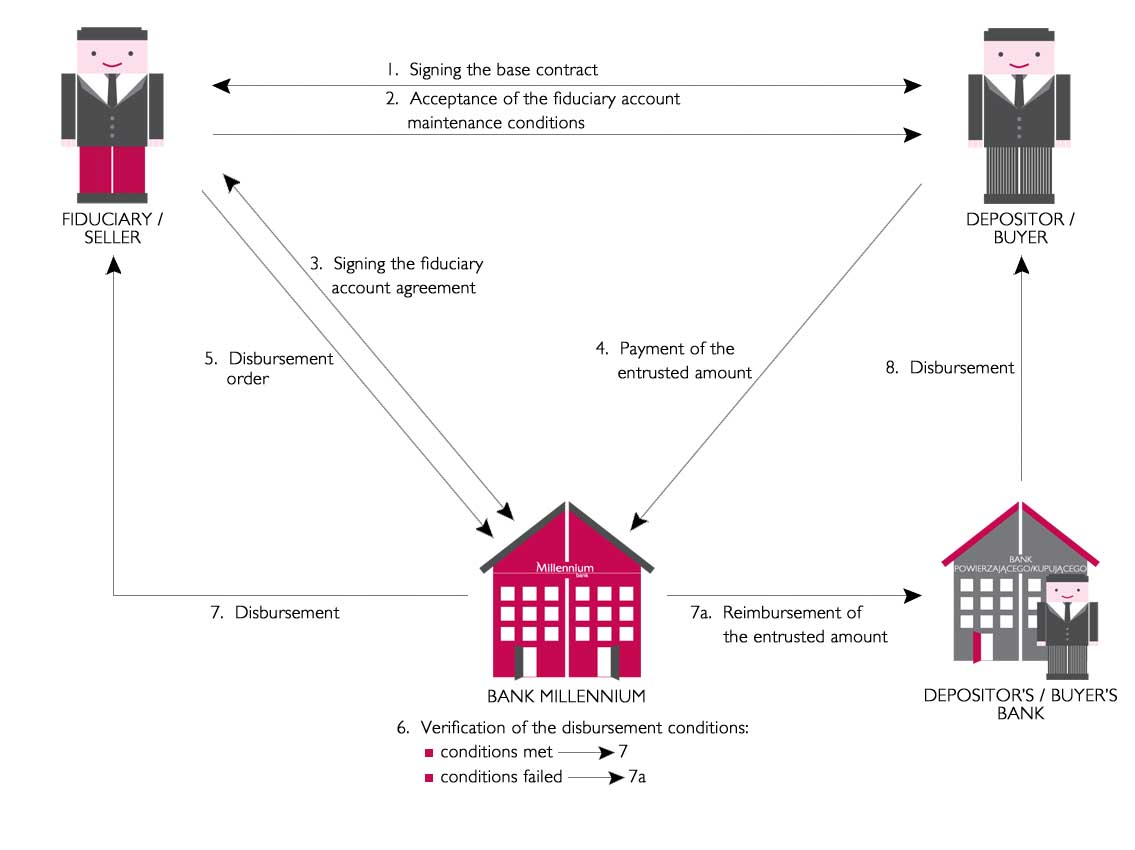

Trust And Escrow Accounts Corporate Bank Millennium

What Is An Escrow Account And How Does It Work Quicken Loans

Average Down Payment For A House Here S What S Normal

Roadmap Sheet Etsy De

Capterra Mortgage Software Comparison Reviews Updated 2023

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

How To Calculate An Escrow Payment 10 Steps With Pictures

How To Calculate An Escrow Payment 10 Steps With Pictures